income tax malaysia login

Time Use by Country Income Level. A tax resident is defined as someone residing in Vietnam for 183 days or more in either the calendar year or a period of 12 consecutive months from the date of arrival.

Income Tax Exemption In Malaysia And How To File E Filing 2022

A simple tax return is one thats filed using IRS Form 1040 only without having to attach any forms or schedules.

. Only certain taxpayers are eligible. How Does Monthly Tax Deduction Work In Malaysia. Companies may claim foreign tax credit for tax paid in a foreign jurisdiction against the Singapore tax payable on the same income.

Copies of tax invoices no longer need to be marked as copy only. Overpaid Taxes Can Be Refunded In The Form Of A Tax Return. Making Tax Digital for Income Tax Self Assessment often shortened to Making Tax Digital for Income Tax or MTD for ITSA is new legislation that will come into effect on 6 April 2024.

The total amount payable. 65 6365 8832 Fax. However theres a goal for all UK businesses to comply in future.

6 to 30 characters long. Situations covered assuming no added tax complexity. Right now only UK VAT-registered businesses are affected by MTD.

It means you have to pay 5 tax on profits of your sale. If the understatement exceeds the greater of 10 of the tax required to be shown on the return or 5000 10000 for corporations other than S corporations or personal holding companies the penalty applies. 9am to 530pm Fri Customer Care.

Self-employed business owners and landlords with property income over 10000 will need to follow MTD for Income Tax Self Assessment rules. May slow down the housing market. MTD will apply to VAT registered businesses with taxable turnover below 85000.

Properties with rental payments exceeding PHP12800 US272 per month received by landlords whose gross annual rental income exceed PHP1919500 US40840 are subject to 12 VAT. Husband and wife separately assessed and each chargeable income does not exceed RM35000. You might already use HMRCs online services to complete tasks such as submitting digital tax returns but MTD for Income Tax will.

If approved the nomad visa will be one of the longest in the world with most countries only offering up to 90 days for digital nomads. Type of rebate. Vietnams Law on Personal Income Tax recognizes ten different categories of income with a host of different deductions tax rates and exceptions applying to each of them.

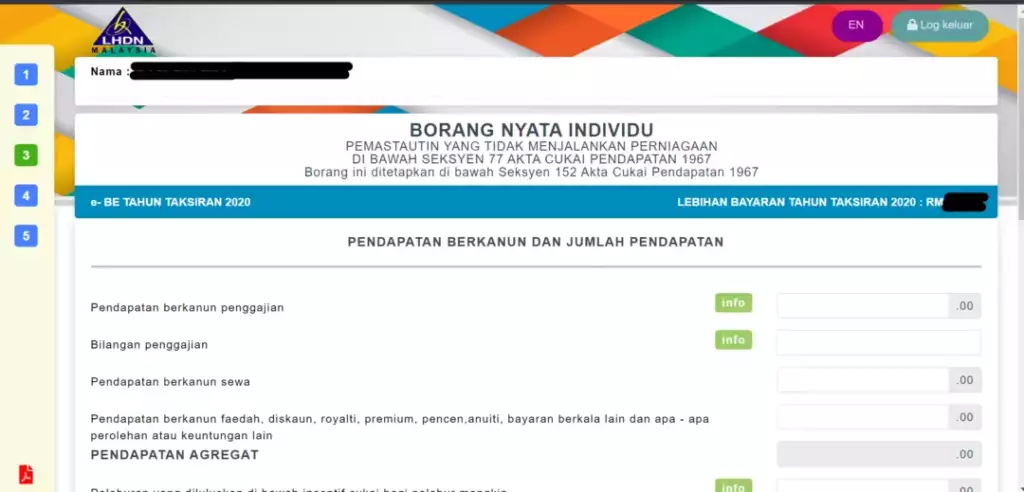

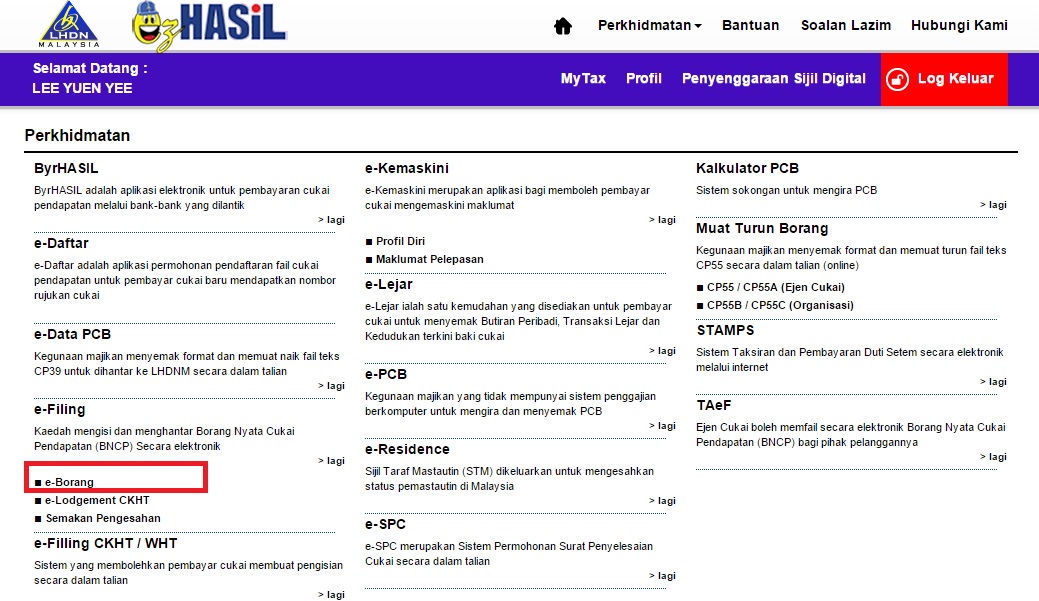

The substantial understatement component of the accuracy-related penalty provides for a dollar criteria. The VAT burden is generally shouldered by the tenants. Guide To Using LHDN e-Filing To File Your Income Tax.

Budget 2019 RPGT Change 5 tax after five years for Malaysians and Permanent Residents. Tax invoices for 1000 or less. 9am to 6pm Mon - Thu Operating Hours.

Reuters provides business financial. According to a statistical brief by the Healthcare Cost and Utilization Project HCUP there were 357 million hospitalizations in 2016 a significant decrease from the 386 million in 2011. See todays top stories.

76 of the population had overnight stays in 2017 each stay lasting an average of 46 days. Council tax rebate 2022. Reuters the news and media division of Thomson Reuters is the worlds largest multimedia news provider reaching billions of people worldwide every day.

How To Pay Your Income Tax In Malaysia. Raises more money for national spending from tax. 5 of the technical service fees and the.

If you issue a tax invoice for standard-rated supplies of goods or services worth 1000 or less including GST it must show the standard information plus. When youll get 150 energy support payment and how to apply Mirror. Login to myTax Portal.

65 6368 1930 Mail. WTOP delivers the latest news traffic and weather information to the Washington DC. The latest Lifestyle Daily Life news tips opinion and advice from The Sydney Morning Herald covering life and relationships beauty fashion health wellbeing.

This is the method the IRS used to convict mob boss Al Capone of tax fraudIn this procedure the IRS. Find financial planning professionals and other resources to help with retirement investing credit repair more. A DTR will be accorded based on the lower of the foreign tax paid in Malaysia ie.

A statement that the total amount payable includes GST. A study by the National Institutes of Health reported that the lifetime per. Must contain at least 4 different symbols.

W-2 income Limited interest and dividend income reported on a 1099-INT or 1099-DIV IRS standard deduction. ATI is calculated by taking the taxable income for the tax year as if section 163j does not apply and then adding and subtracting certain amounts from it for the year. 52 Sungei Kadut Avenue Star Building Singapore 729675 Tel.

This publication is the tenth edition of the full version of the OECD Model Tax Convention on Income and on CapitalThis full version contains the full text of the Model Tax Convention as it read on 21 November 2017 including the Articles Commentaries non-member economies positions the Recommendation of the OECD Council the historical notes and the background. Examples of amounts added back include deductions for interest net operating losses and for tax years beginning before 2022 depreciation amortization and depletion. In middle income countries youth are more likely to be students wage employed or NEET in low income countries youth are more likely to be self-employed or underemployed.

ASCII characters only characters found on a standard US keyboard. Tax Offences And Penalties In Malaysia. The best opinions comments and analysis from The Telegraph.

From The Financial Planning Association. Amount RM Individual chargeable income less than RM35000. 5 A 12 Value Added Tax VAT is imposed on residential property leases that satisfy certain conditions.

Indonesia is still mulling the prospect of its own digital nomad visa which would offer holders up to five years of tax-free stay if they can prove their income is derived from outside of Indonesia. What is Making Tax Digital for Income Tax. IRS estimates 270 billion in revenue lost to unreported income 0238.

May help reduce speculation although property speculation is usually a short-term gain More tax.

How To File For Income Tax Online Auto Calculate For You

Tis The Season To File Your Taxes Again So We Thought We D Help You Out With E Filing Rojakdaily

9 Income Tax Ideas Income Tax Tax Income

Online Businesses Tax Morale In Supply Chain Relationships Semantic Scholar

Malaysia Personal Income Tax Rates 2022

How To File Income Tax In Malaysia Using E Filing Mr Stingy

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Ctos Lhdn E Filing Guide For Clueless Employees

How To File Your Income Tax In Malaysia 2022 Ver

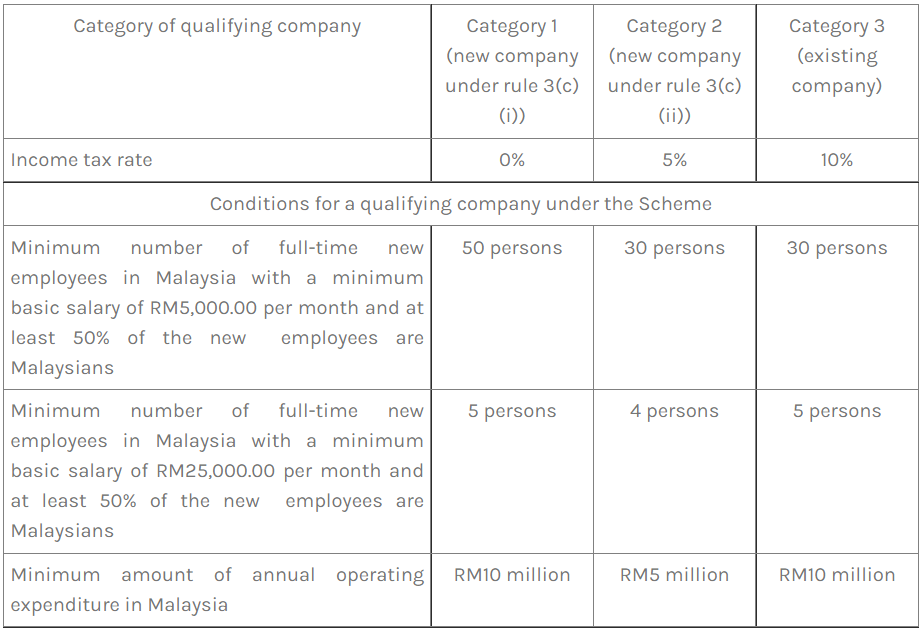

Principal Hub Tax Incentive Rules 2022 Lexology

E Filing Beginners Guide Income Tax Malaysia 2022 Youtube

Updated 2021 Tax Reliefs For Ya 2020 And How To File Income Tax In Malaysia Using Lhdn E Filing Iproperty Com My

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

How To File Income Tax In Malaysia Using E Filing Mr Stingy

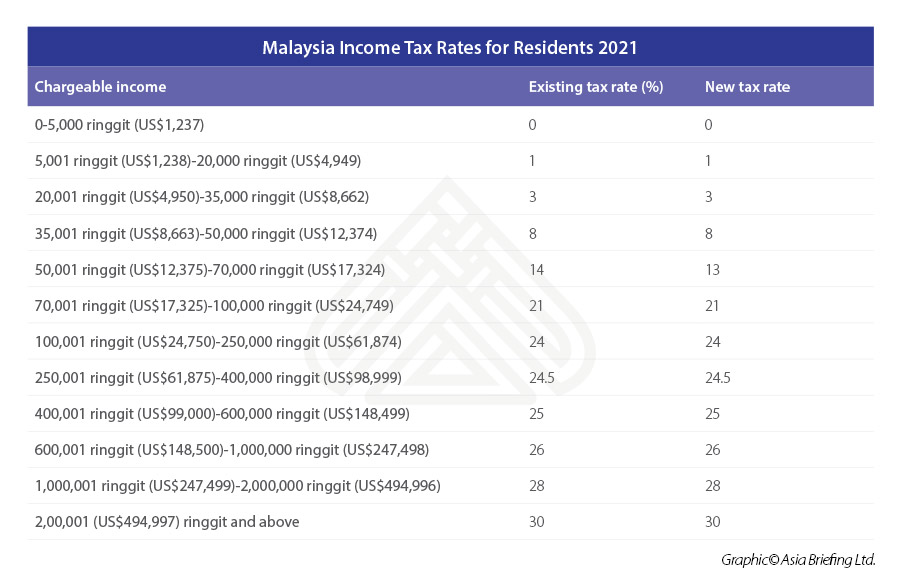

Malaysia Income Tax Rates For Residents 2021 Table Asean Business News

St Partners Plt Chartered Accountants Malaysia Individual Income Tax Rate For Ya 2 0 2 0 Facebook

Malaysian Tax Issues For Expats Activpayroll

Income Tax Rate Comparison Between Malaysian Singaporean R Malaysia

0 Response to "income tax malaysia login"

Post a Comment